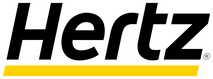

Consumer interest in purchasing electric vehicles has declined from last year, according to the latest AAA annual consumer survey on EVs. Only 18% of U.S. adults reported they would be “very likely” or “likely” to buy a new or used EV, down from 23% last year. Perhaps more compelling, 63% said they were “unlikely or very unlikely” to select an EV for their next car purchase.

In another wake-up for the industry, about 40% of current U.S. EV owners said that, when it came time for their next car, they would be switching back to a combustion vehicle, according to the McKinsey & Co. 2024 Mobility Consumer Global Survey.

American drivers cited the lack of an extensive charging infrastructure as their biggest concern. Globally, 29% of EV owners said they were rethinking their choice, also because of limited infrastructure, as well as ownership expenses and the impact on long-distance trips.

“In the U.S., EV market jitters inflamed by the upcoming presidential election helped slow down adoption this year, and by 2027, only 29% of cars sold in the country [will be] electric,” according to the report.

Other research indicates that U.S. EV sales continue to increase – but not as fast as earlier projections or the rates overseas.

Concerns about the cost of new vehicles, range anxiety and the lack of convenient charging infrastructure are draining American consumers enthusiasm for electric vehicles, according to AAA’s EV survey, not to mention the difficulty and prohibitive expense of installing home charging stations, listed by 3 out of 10 respondents.

“Early adopters who wanted an EV already have one,” according to Greg Brannon, director of automotive research at AAA. “The remaining group of people who have yet to adopt EVs consider the practicality, cost, convenience and ownership experience, and for some, those are big enough hurdles to keep them from making the jump to fully electric.”

The International Energy Agency’s Global EV Outlook shows that global EV sales could reach 17 million in 2024, and by 2035, the IEA predicts 50% of all cars sold worldwide will be EVs. In the U.S., the second largest auto market in the world, behind China. EV sales are projected to increase by 20% from 2023, totaling about 11% of all new car sales.

Still, the U.S. adoption rate is lagging behind forecasts. Projected U.S. sales figures from Bloomberg New Energy Finance called for sales of 1.7 million plug-in vehicles in 2023 (that includes hybrids), but only 1.46 million sold. Reasons include high prices, the lack of charging capacity and unclear rules for tax credits.

The U.S. also took longer than most countries to reach a critical “tipping” point. When 5% of new car sales are purely electric, it signals the start of mass adoption, after which technological preferences shift, according to Bloomberg. By the last quarter, fully electric cars accounted for 8.1% of U.S. auto sales, which is below the 18.1% average for 20 countries.

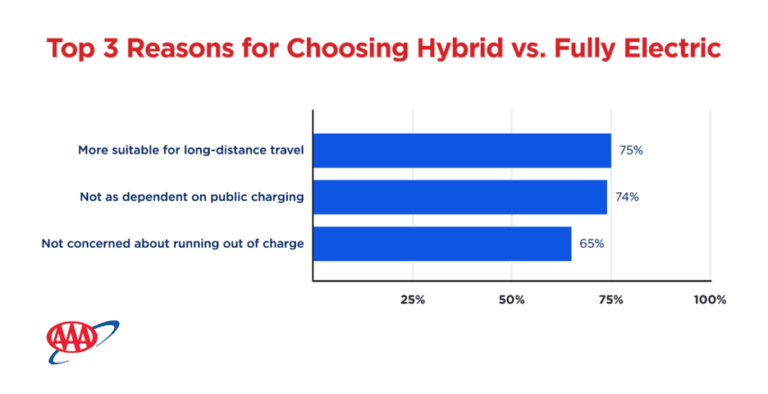

On a positive note, AAA’s survey revealed that more consumers would consider purchasing hybrid vehicles, with 1 in 3 U.S. adults (31%) saying they would be “very likely” or “likely” to buy a hybrid. Hybrid vehicles allow people to enjoy the benefits of electrification without the anxiety about disrupting their lifestyle or travel plans, because they can travel longer distances and are not as dependent on charging stations.

Three-quarters of respondents said hybrids are more suitable for long distance travel than fully electric vehicles. Other benefits of hybrids identified by respondents include not being tied to finding public places to charge (74%), not experiencing range anxiety (65%), not needing to install a home charging station (54%) and lower purchase prices (53%).

The AAA public affairs team has found that while many consumers want more efficient and sustainable vehicles, some are not ready to commit to EVs and are finding that hybrids are a better fit for their lifestyles.

To help educate consumers, AAA conducts ongoing research on EVs, including consumer sentiment surveys, testing to determine factors impacting electric vehicle range, the actual cost of electric vehicle ownership and a survey on consumers’ experience with going electric.

AAA’s Recommendation: Whether you own an electric vehicle or a gas-powered car is up to you – and you should consider lots of factors in making that choice. No matter what type of vehicle you’re choosing, we recommend visiting a dealership, test driving one, and asking as many questions as possible to make an informed decision.