Every year, more motorists are making the jump to electric vehicles. But even the most fervent EV devotee may find themselves stricken with a full-blown case of sticker shock when they take a look at the car’s price tag. There’s no getting around it – EVs cost more than similar model gas-powered cars.

But as we all know, the cost of buying a vehicle is much different than the cost of owning a vehicle. This is where EVs become more appealing from a dollar-and-cents perspective. Between tax credits, financial incentives and significantly lower operating expenses, these green vehicles are more financially practical in the long run than you may believe. In fact, over lifetime ownership, you may find an EV to cost about the same as gas-powered car.

Let’s break down the full cost of an EV, from purchase price through operating costs.

Just like gas-powered vehicles, EVs come in a wide range of price points. The most affordable models start below $30,000, while high-end, luxury cars can go well into the six-figures. The price of some of the most popular EV models include:

AFFORDABLE:

- Nissan Leaf: $27,400

- Mini Cooper SE: $29,900

- Chevrolet Bolt EV/EUV: $31,500; $33,500

MID-RANGE:

- Volkswagen ID.4: $41,230

- Mustang Mach-E: $43,895

- Tesla Model 3: $46,900

HIGH-END:

- Audi e-tron: $65,900

- Tesla Model Y: $65,990

- Jaguar I-Pace: $71,300

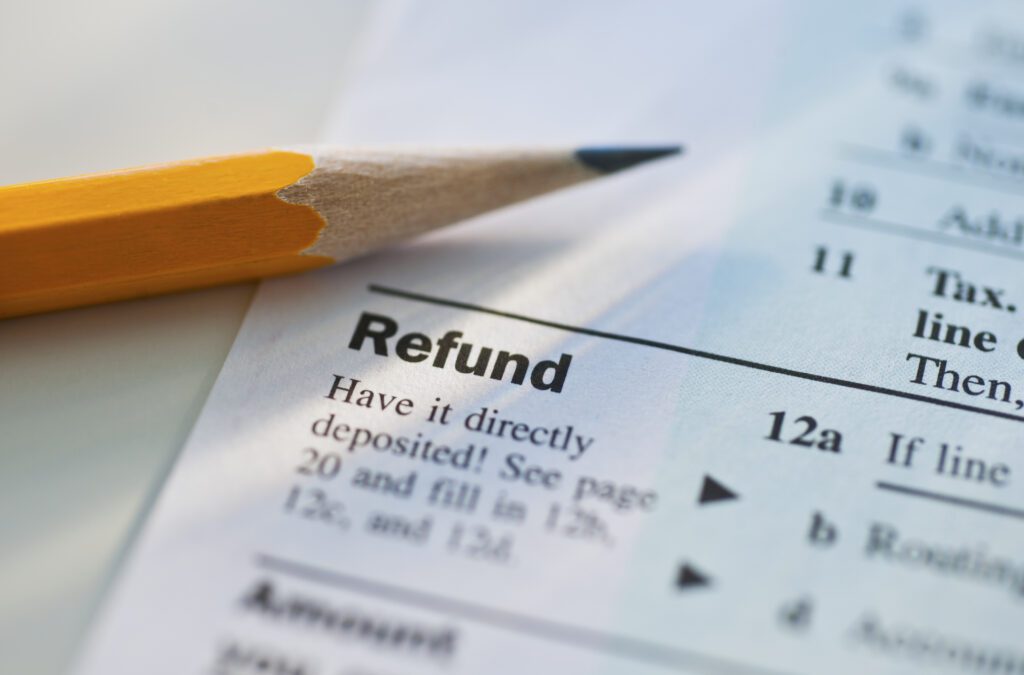

There are numerous financial incentives available to EV customers. The most noteworthy tax incentive available is the federal tax credit, worth up to $7,500.

Although manufacturers might advertise the federal tax credit as a discount, it is not. You will have to pay the car’s full price at the time of purchase.

The federal tax credit only applies to new car purchases. If you are leasing an electric vehicle, the credit can be claimed by the car company. Manufacturers may pass some of those savings on in the form of lower monthly payments, but it’s not guaranteed.

It’s important to note you may not receive the full federal tax credit amount your electric vehicle is eligible for. The credit is non-refundable, meaning the government will not be writing you a check if you purchase an electric vehicle. Instead, the credit is applied to your tax liability, and at best, it can reduce your tax bill to zero. For example, if you are eligible for a $7,500 credit and you owe $5,000 in taxes, you will only receive a $5,000 credit. The remaining portion goes unused and cannot be applied to next year’s taxes.

The initial upfront cost of EVs is generally higher than that of similar gas-powered cars. However, motorists will begin earning back the difference once they get on the road. Most notable amongst those savings is the absence of visits to the gas station. Electricity isn’t free, of course, but it’s typically less expensive than gasoline. Over time, that difference adds up. Past research done by AAA found that the electricity required to drive an EV 15,000 miles per year costs an average of $546, while the amount of gas needed to drive the same distance costs $1,255. This was before gas prices skyrocketed in 2022, creating an even greater potential windfall in savings.

EVs also typically cost less to maintain than gas-powered cars. The absence of an engine means one less component that can malfunction. It also removes the need for oil changes and air filter replacements. As such, EV owners can spend hundreds of dollars less in annual operating costs.

Add all these savings together and the true cost of owning an EV is comparable to that of a traditional gas-powered car.

AAA’s Recommendation: Whether you own an electric vehicle or a gas-powered car is up to you – and you should consider lots of factors in making that choice. No matter what type of vehicle you’re choosing, we recommend visiting a dealership, test driving one, and asking as many questions as possible to make an informed decision.